Although the Inland Empire economy is poised for another year of solid growth, record-low unemployment and a limited housing supply will constrain the region’s current upward trajectory into the future, according to an analysis released today by the UC Riverside School of Business Center for Economic Forecasting and Development.

In the latest jobs numbers, employment in the Inland Empire expanded by a healthy 3.1% over the past year, considerably outpacing growth in the state (2.1%) and the nation (1.6%). At the same time, unemployment in the area has dropped to the lowest on record even as the population has grown faster than in the state or in surrounding Southern California regions.

“The Inland Empire enjoys a range of significant affordability advantages compared to its immediate neighbors and other parts of California,” said Robert Kleinhenz, executive director of research at the Center for Economic Forecasting. “The natural result is that more people will choose to live, and if possible, work here.”

The worker scarcity that has been intensifying across the nation, however, will make it increasingly tough for Inland Empire employers to hire the labor they need, limiting future employment and industry growth, said Kleinhenz.

On top of a shortage of workers is an insufficient supply of homes, another factor that will eventually put a check on the economy’s ability to expand, according to the analysis. Population and job growth is escalating the demand for housing in the Inland Empire and inflating home prices and rents.

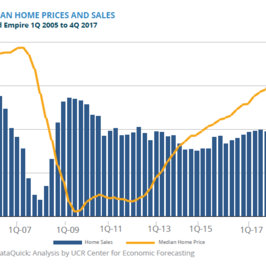

The median price of an existing single-family home increased to $352,800 in the first quarter of 2018, a 9.4% jump from one year earlier. During the same time, average asking rent increased to $1,319 per month, up 3.0%.

There has been a response to the demand, however, as residential construction activity has increased. Building permits have risen (there were 3,020 residential units permitted in the first quarter of 2018 – a 4.7% year-over-year increase) and taxable sales receipts in the Building and Construction category have jumped, indicating that developers are using local suppliers. These additions to the housing stock will temper, but not hold back, advancing home prices.

“Still,” said Kleinhenz, “although recent market behavior may induce flashbacks to the years preceding the Great Recession, the driving forces behind the current cycle are starkly different and display no signs of a bubble.”

Additional Key Findings

- Driven by a tight labor market, wages in the Inland Empire have grown, increasing by 2.5% in Riverside County and 2.3% in San Bernardino County in 2017. Although the growth has been modest and lags the state overall, appreciable wage increases are expected to occur in the region in 2018.

- During the first four months of 2018, passenger traffic through the Ontario International Airport jumped 10.7% over the same period in 2017 – representing the best growth since 2010. This is indicative of the strong tourism and visitor activity the Inland Empire is currently enjoying. Indeed, both hotel occupancy rates and room rates have risen.

- Along with the ongoing economic expansion, the Inland Empire’s commercial real estate market is on the rise. Permitting for new nonresidential structures in the first quarter of 2018 was 43.5% higher than during the same period in 2017 and 70.5% higher than during the same period in 2016, reaching $648.3 million in total value.

The new Inland Empire Regional Intelligence Report examines employment, consumer and business spending, and residential and commercial real estate. Please view the complete analysis here.