Using a unique prototype comparison of the different components that go into multifamily housing development, a new analysis illustrates why development in Southern California, and especially Los Angeles, is so expensive. The report, released today by the UCR School of Business Center for Economic Forecasting and Development, finds that building condominiums in Los Angeles costs about $100,000 more per unit than in other nearby Southern California cities.

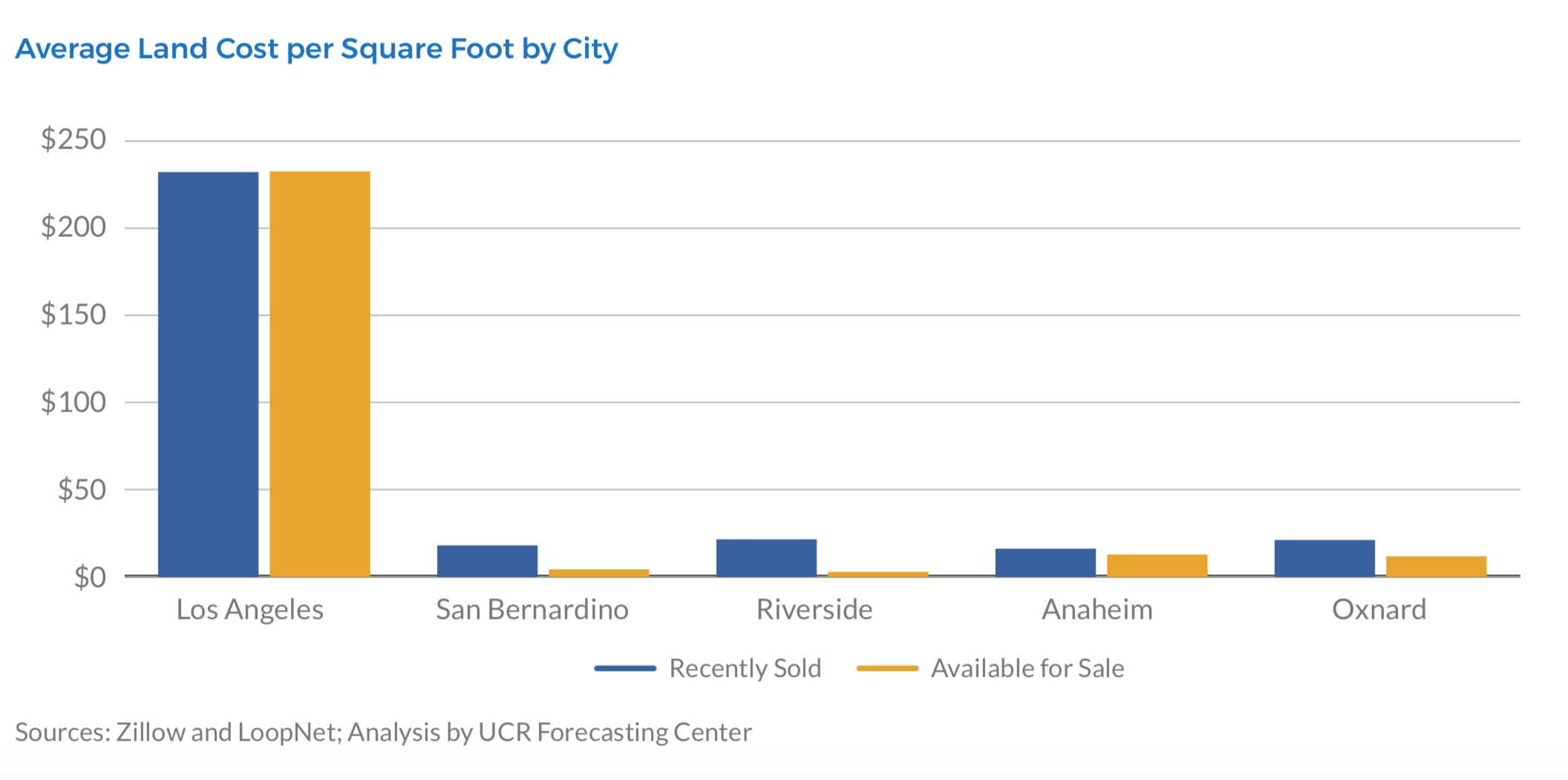

“The fundamental reason for the difference comes down to the value of the land,” said Hoyu Chong, Lead Researcher at the Center for Forecasting and the report’s author. “Los Angeles is an enormous world-famous city, ten times the size of the other locations studied, and that concentration of economic opportunity, industry, and activity means the land comes with a significant cost premium.”

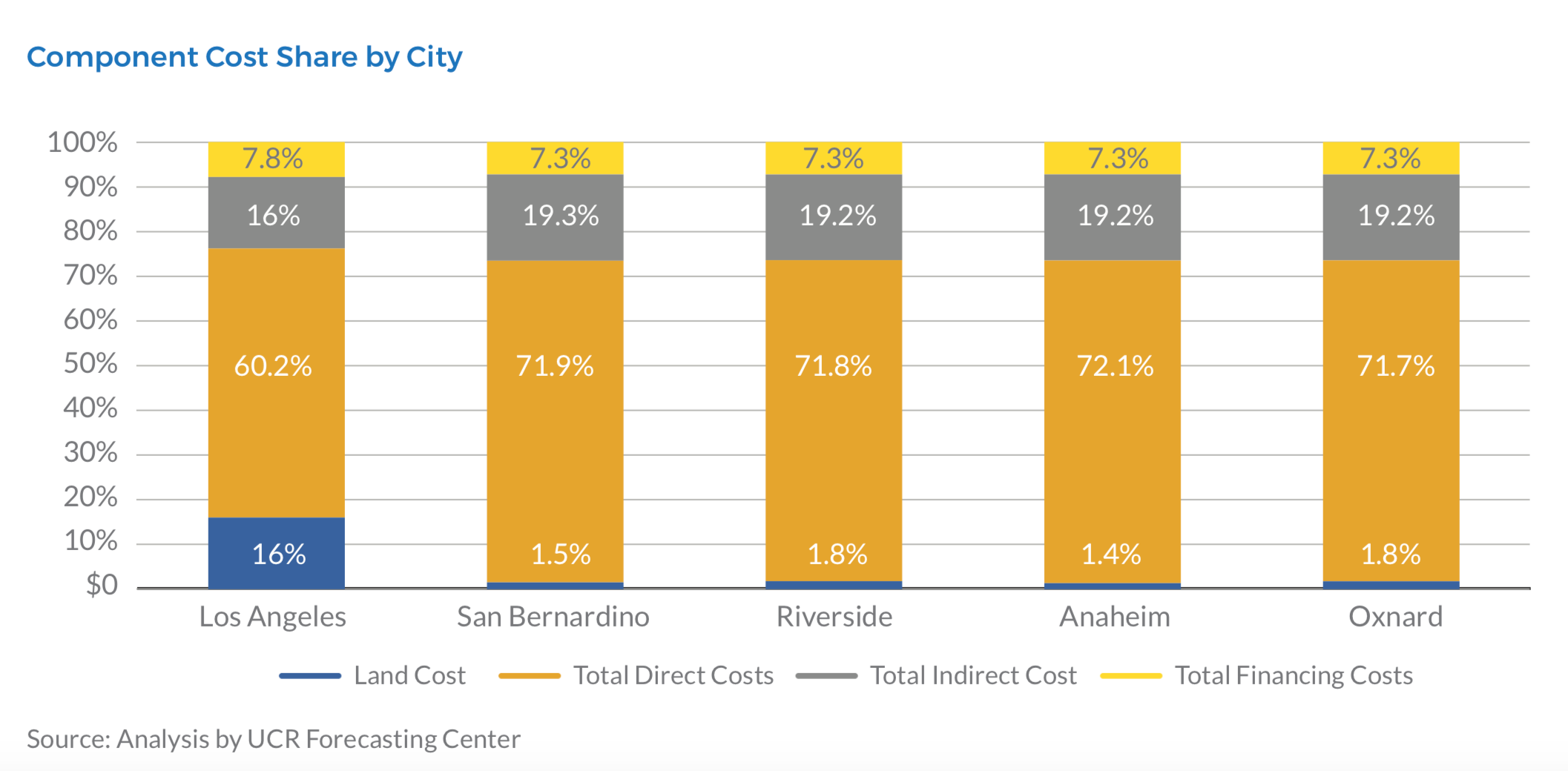

According to the analysis, in Los Angeles, land costs account for nearly one-sixth of a multifamily project’s total development cost compared to less than 2% in other Southern California cities studied (the cities of Anaheim, Oxnard, San Bernardino, and Riverside were used alongside Los Angeles in the prototype analysis).

“What this research tells us is that the high cost of Los Angeles land, which stems from both the huge opportunity the city offers and the difficulty of building here, needs to be addressed with policies that promote more efficient land use, whether that’s prioritizing housing units over parking spaces or allowing more people and more units on a given parcel,” said Adam Fowler, Director of Research at the Center for Forecasting. “Affordable housing by definition is multifamily housing, and where land is expensive, that cost needs to be distributed among more people in order to promote affordability.”

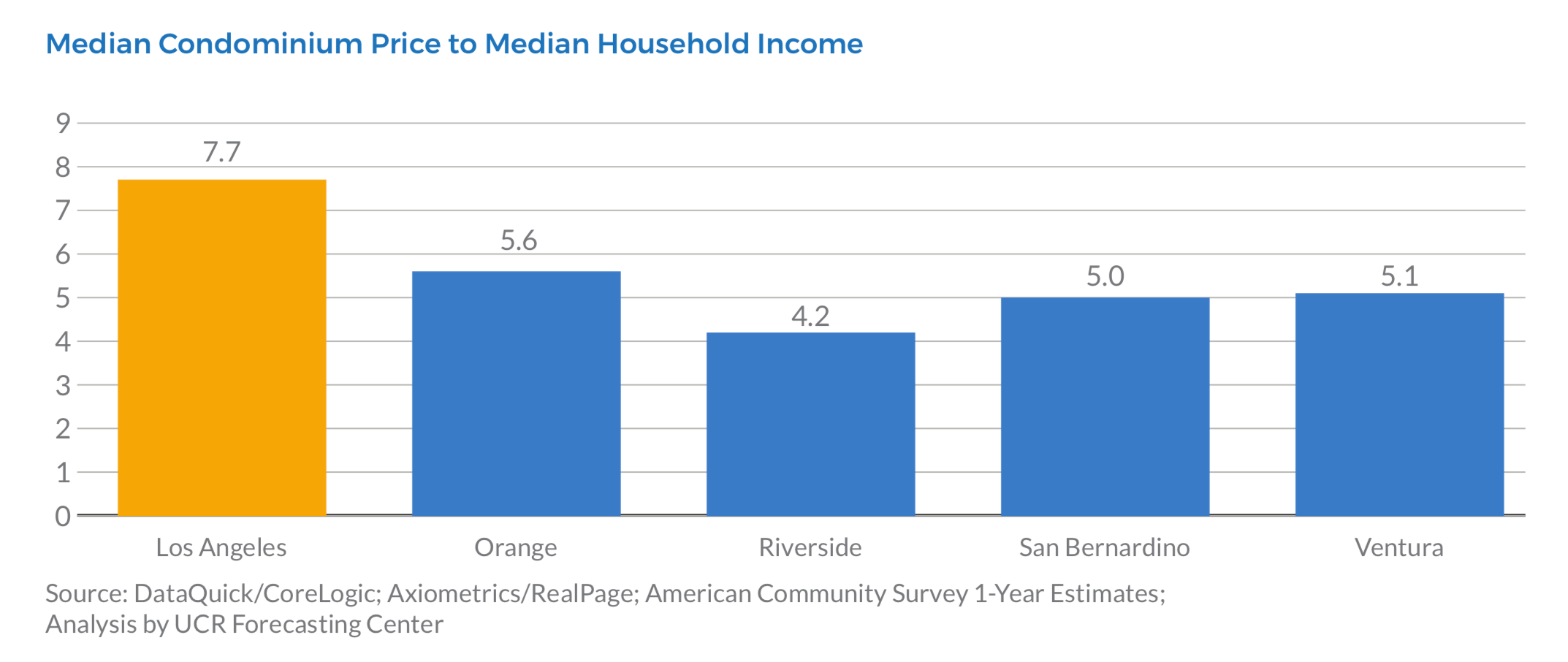

The report also examined countywide data and found that Los Angeles County is the most ‘cost burdened’ in terms of both purchasing condominiums and renting apartments. In all the counties studied, median condo prices and effective rent have increased at much higher rates than median income over the past decade, however, Los Angeles is a clear outlier.

The median condo price-to-household income ratio in Los Angeles County is 7.7, more than double what is considered to be healthy (a ratio of 3 is recommended), and considerably higher than Orange County (5.6), the next most burdened county. Moreover, Los Angeles County is the only county in the study group where the median rent-to-income ratio (39%) is higher than the 30% recommended by the U.S. Department of Housing and Urban Development.

“It’s not surprising that Los Angeles residents are feeling the greatest pinch considering how much of their income has to be spent on housing,” said Chong. “Breaking down actual housing development components gives us a sharper view into exactly what makes development so costly and while public officials can’t control the costs of labor, building materials, or other market variables, they can support changes to zoning and land use that will have a meaningful effect on reducing housing unit costs and increase affordability for Southern California families.”

The complete analysis, Demystifying the High Cost of Multifamily Housing Construction in Southern California, is available here.