The economy that houses industries such as entertainment, media, fashion, and fine arts in California has weathered the pandemic and, as a whole, done better in its recovery from the COVID-driven recession than the overall economy, according to a new analysis released today by the UCR School of Business Center for Economic Forecasting and Development.

The study, Shock and Roll: California’s Creative Economy from 2015-2021, examines trends in the state’s creative industries prior to, during, and following the pandemic recession, finding that the creative economy has added a total of 70,064 jobs since 2015 and appears to be bouncing back to its 2019 pre-pandemic peak. Additionally, the creative economy workforce in California grew 8% over the study period, significantly faster than the overall workforce.

Even more impressive has been wage growth. On average, in California’s creative economy, per worker wages have increased a spectacular 40% since 2015. Wages among creative economy workers were already relatively high in 2015 at 1.8 times the average California worker wage, but by 2021, the average worker wage in the creative economy was 2.35 times higher. Indeed, creative economy wages started higher and accelerated during the pandemic, even outstripping today’s historic inflation.

“California is a global epicenter of the creative economy, and its industries are an engine of growth for the state and its workers,” said Patrick Adler, research manager at the Center for Economic Forecasting, and one of the report’s authors. “By looking at conditions and trends that were in progress before the pandemic as well as changes since, we’re able to put the COVID shock in proper context; our main finding is that the 2020 disruption did not throw the creative economy off its previous gains.”

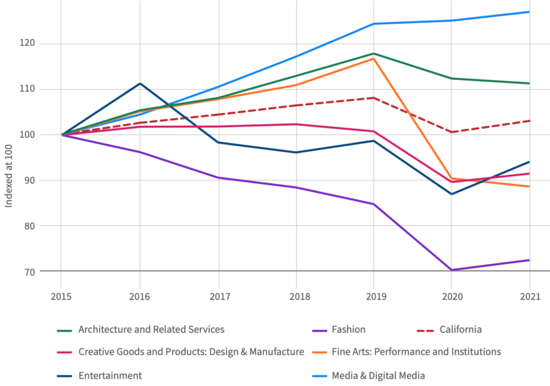

The report’s topline analysis comes with a critical caveat: Many different sectors, producing widely different kinds of products, make up the creative economy. The findings indicate that both longer-term performance, and the more recent recovery from the pandemic, varies considerably from sector to sector with some soaring and others declining.

The media sector, which includes digital publishing, is the true stand out the sector that keyed creative economy growth in the 2015-2021 period. Media currently makes up 31.2% of all creative economy employment in the state and accounts for over half (53.3%) of all the creative economy wages paid. By themselves, digital publishing industries have added 125,885 jobs since 2015 and, counter to macro trends, added 12,216 jobs during the pandemic period alone.

The architecture and related services sector is the only other major creative sector that had more jobs in 2021 than in 2015; all the others have lost employment since 2015. Unsurprisingly, fine arts and performance was hit hardest by the pandemic, given health mandated restrictions on group activity, and fashion stands out as the one sector that has been in almost steady employment decline since 2015.

The analysis is part of the Center for Economic Forecasting’s ongoing research about California’s creative economy, its industry sectors, and workforce. Amid the angst of the pandemic and its economic effects, Adler and his co-authors hope that providing clear diagnostics that reach back well before the COVID-19 crisis, as well as during and after, will inform long range economic and workforce development efforts within the creative industries.

“There is an important, broader context that shows us certain industries were headed one way or another before the pandemic,” said Adler. “The state’s leaders ought to be thrilled with the long-term dynamism in digital publishing, and more concerned by declines in entertainment and creative manufacturing.”

The report is accompanied by an online appendix containing a variety of graphs, figures, and maps that provide additional, drilled-down detail.

The complete analysis is available here. The appendix is available here. This report was authored by Adler, Research Associate Andrew Yu and Senior Research Associate Brady Allardice. Additional contributions by Research Associate Kailei Lin.

Header photo: hugolacasse/Getty Images