Throughout the pandemic the Inland Empire’s relatively affordable housing market has been a bright spot in the local economy and home price growth has outpaced more expensive neighboring areas. That affordability, however, has diminished in the face of today’s higher mortgage rates and in the context of elevated demand and extraordinarily high-priced markets across the state, according to an analysis released today by the UC Riverside School of Business Center for Economic Forecasting and Development.

Today, only 31% of local households can afford to purchase a median-priced home in the Inland Empire, a decrease from a relatively low 39% in the first quarter of 2021. Still, the region remains one of the most affordable in all Southern California and is more affordable than the state as a whole where just 24% of households can afford a median-priced home.

“Honestly, this is what affordability looks like in California,” said Taner Osman, Research Manager at the Center for Economic Forecasting and one of the report’s authors. “Housing prices are at the crux of the state’s famously high cost of living and are out of reach to the majority of the population as lack of supply enduringly and severely lags demand.” The contrast with the nation overall, where 45% of households can afford median-priced homes, is stark.

As of April 2022, there were only 1.7 months of housing supply available for purchase in Riverside County and 2.2 months in San Bernardino County. A balanced market typically has 6 to 7 months of supply. Moreover, homebuyer demand, which intensified due to the pandemic-driven economic stimulus, remains high as home sales decrease in the face of limited inventory.

Additional Key Findings:

- No labor market slowdown yet: Despite growing recessionary fears, the short-term economic forecast for the Inland Empire is strong. The labor market continues to show vigor with an unemployment rate (3.7%) that is lower than it was pre-pandemic (4.1%). More than 280,000 jobs have been added in the region since April 2020, surpassing the 228,000 that were lost due to pandemic related shutdowns.

- Inflation chips away at wage growth: Local wage growth has been strongest in Riverside County where wages increased 3% from the third quarter of 2020 to the third quarter of 2021 (the latest data available). Wages in San Bernardino County have grown 1.7%. Despite the upturn, real wages decreased during the year due to high inflation.

- Consumer demand, fuel prices send taxable sales soaring: Taxable sales receipts in the Inland Empire jumped a hefty 23.8% in the latest annual data. The surge has been primarily driven by high fuel prices and more spending in the Business and Industry category where receipts swelled 57%. Fuel and Service Station receipts expanded almost as much (56%).

- E-commerce trends keep warehouse space red hot: In the last edition of this report, the vacancy rate among warehouse properties in the Inland Empire was an already low 3.6%. As of the first quarter of 2022 (the latest data available), the vacancy rate has fallen to 3.2% despite a whopping 34.6 million square feet of new space coming online. Driven by strong consumer spending in E-Commerce, warehouse space has become increasingly scarce and asking rents in the Inland Empire grew 6.3% in the latest data. But the region is still more affordable than Los Angeles, San Diego, or Orange Counties.

- Rental market surges: Demand for apartments continued to intensify in the Inland Empire over the last year with the vacancy rate falling to 3% and asking rents expanding by more than 21% to reach an average of $1,807 per month per unit. But even with the increase, rent in the region is significantly more affordable than in Los Angeles ($2,236), Orange ($2,335), and San Diego ($2,226) Counties.

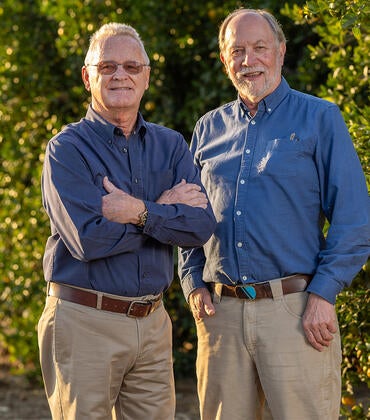

The new Inland Empire Regional Intelligence Report was authored by Osman and Senior Research Associate Brian Vanderplas. The analysis examines how the Inland Empire’s labor market, real estate markets, and other areas of the economy have recovered from the COVID-19 pandemic and their outlook for the remainder of the year. View the full analysis here.