Californians love renewable energy. In fact, California just became the first state to require solar panels on all new homes. But the new requirement creates questions. How will the new law complicate the electricity market? What strains will it place on existing distribution networks?

As California scrambles to meet a 2030 deadline to receive 50 percent of its electricity from renewable sources, the state needs to find ways to track, measure, and value electricity consumption and production that account for the variability of electricity that comes from decentralized sources, such as solar, wind, and batteries. Without careful management, these sources, known as distributed energy resources, or DERs, have the potential to cause unreliable power delivery, or even outages, and lead utility companies to overcharge customers.

A new paper by electrical engineers in the Marlan and Rosemary Bourns College of Engineering at the University of California, Riverside, offers a way to account for uncertainties introduced by both the electricity market and DERs so utility companies can balance the distribution grid and find the fairest customer rates.

One way managers of the electricity market ensure equitable distribution of power is by offering incentives for customers to reduce, or defer, power consumption during peak hours. Customers can choose to use less electricity or shift their use to a distributed source, such as rooftop solar panels or batteries. Customers can also make more electricity available during peak loads by selling to the utility excess electricity generated by their rooftop solar panels. Consumers can thus exert a strong influence on the wider electricity grid and market.

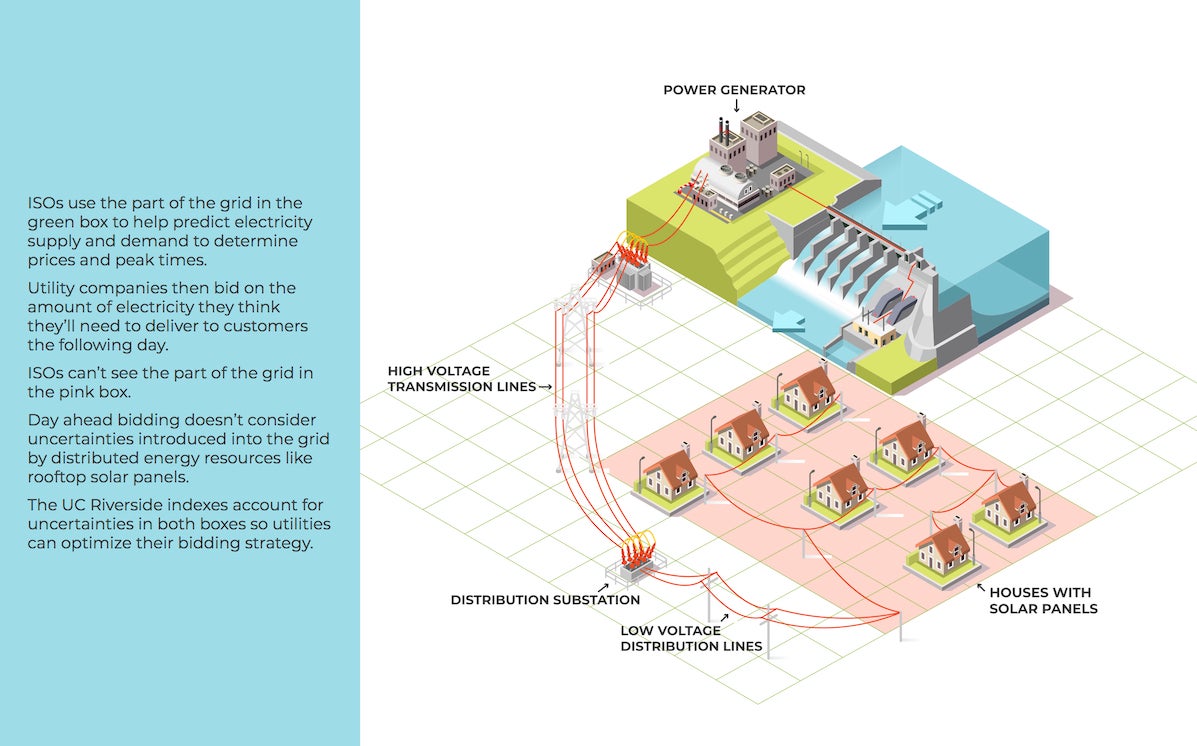

The problem, according to the researchers, is that the organizations overseeing the grid as a whole, known as independent system operators, or ISOs, do not dispatch, and often can’t see, the location of network DERs. They only see transmission lines and resources connected to them, such as collective demand at the substations and power plants. They determine market conditions based on the big picture without knowing details that might have important consequences in the power grid.

“ISOs see the electricity up to the substation that feeds it into a consumer network but are blind to what happens among the thousands or millions of customers after that point,” explained Ashkan Sadeghi-Mobarakeh, a UC Riverside doctoral student in electrical and computer engineering and first author of the paper. “The demand of each customer at each location has a different local impact on the distribution network.”

California ISO, or CAISO, has introduced a new index to better manage flexible and responsive loads according to the market conditions. But the index suggests deployment of flexible loads only according to market conditions, meaning CAISO’s index doesn’t consider that market participation of DERs located in distribution networks may push a network’s limits.

If CAISO or the utility determine times to deploy or defer electrical loads without accounting for variable on-site renewable resources and distribution network conditions, they risk overloading the network and causing outages. Contrary to common sense, reducing electricity delivery to distribution feeders at peak load could lead to higher costs and decrease grid stability.

The UC Riverside paper considers not only the market conditions, but also the impact flexible resources have on distribution network constraints.

Sadeghi-Mobarakeh used novel algorithms to model cost and electrical loads in different market scenarios and tested them on a standard distribution network. He used his algorithm to compare the cost and stress on the distribution network to what would be predicted by the conventional model. He found that if the utility company had bid according to his model, it could have delivered power to consumers at considerably lower cost on many days, with less risk to the network.

The researchers propose two new indexes to help utilities look beyond market conditions and identify feeders with better performance for the operation of deferrable loads. They suggest ways that DERs can actively participate in the electricity market by following market signals. The two indexes show how a good feeder responds to market signals without having a negative effect on the distribution network. The new indexes can help utility companies determine an optimal bidding strategy in the day-ahead market, together with the optimal schedules for deferrable loads.

“The indexes proposed in this paper can be combined with field measurements from smart meters at substations to measure in real-time the collective impact distributed energy resources have on distribution system reliability,” Sadeghi-Mobarakeh said.

In addition to Sadeghi-Mobarakeh, the authors include his adviser, Hamed Mohsenian-Rad, a professor of electrical and computer engineering at UC Riverside; Alireza Shahsavari, a doctoral student at UC Riverside; and Hossein Haghighat of Islamic Azad University of Jahrom.

The paper will appear in an upcoming issue of IEEE Transactions on Smart Grid. An early access version of the paper is available online as:

“Optimal Market Participation of Distributed Load Resources Under Distribution Network Operational Limits and Renewable Generation Uncertainties,” Ashkan Sadeghi-Mobarakeh, Alireza Shahsavari, Hossein Haghighat, and Hamed Mohsenian-Rad. IEEE Transactions on Smart Grid 10.1109/TSG.2018.2830751

(banner photo credit: Tony Webster on Wikimedia Commons)